How to write year -end adjustments [2021 (3 years for Bandwa)] Illid the changes in this year and the entry examples of 3 declarations -Internet Watch

The salaried worker's autumn to the end of the year, "year -end adjustment" has arrived.A certificate of insurance deduction will have arrived from the life insurance company.The year -end adjustment period is long, depending on the company you work, there is a difference of one and a half months in late October, mid -November, and late December.In general, companies with a large number of employees are early, and small companies are late, but many large companies are incorporated into internal systems and have become easier because they can take over the previous year's data.

Nevertheless, it is true that there are many sad comments on SNS every year, such as "I don't understand," "It's troublesome," "no postcard (deduction certificate)," and "it's over time."Here, we can solve "I don't know how to write", and illustrate how to write year -end adjustments in three times, such as a countermeasure for "after the deadline", and introduction of tools that easily calculate the troublesome life insurance deduction.Let's explain in detail.I would like you to be a little interested in taxes, as the year -end adjustment, withholding slip, final tax return, and tax topics for spring will increase.

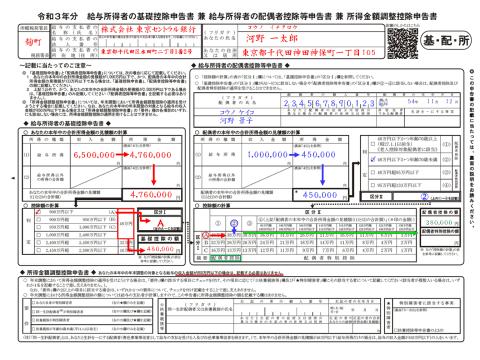

For the first time, let's look at the entry example of the three declarations and how to write the "Basic deduction declaration of the three -year salary income person, a spouse deduction, etc. and a deduction of income amount".

2021 (3 years for Bandwa) How to write year -end adjustment [Table of Contents]

- 今年の変更点や提出書類の記入例(この記事)- 3枚の申告書の記入例- 「キーボードで入力したい」人は申告書の入力用ファイル(PDF)を活用しよう- 年末調整とは- サラリーマンの所得税の計算方法- 今年の変更点は?- 「令和3年分 給与所得者の基礎控除申告書 兼 配偶者控除等申告書 兼 所得金額調整控除申告書」の記入手順- 年収から所得金額を算出する方法=適当でいいんじゃね- 年収850万円を超える人は「所得金額調整控除」

- 「令和3年分 給与所得者の保険料控除申告書」の記入手順(別記事)

- 「令和4年分 給与所得者の扶養控除等異動申告書」の記入手順(別記事)