"Insufficient average savings in 40s" Trouble of couples who could not save due to Korona-ka

Image Image (pixta)

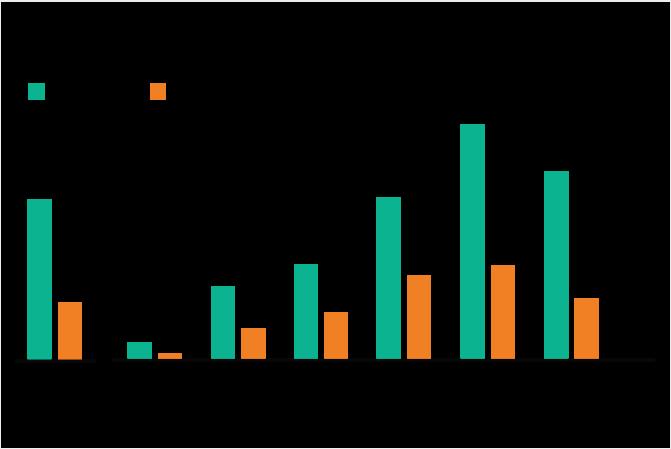

FP's household budget consultation series where professional financial planners answer your concerns about money such as household budgets, insurance, and loans from readers. The counselor this time is a 43-year-old female office worker. She is a counselor who lives with her husband who is an office worker of the same age. She hasn't saved much since her income diminished due to Korona-ka, and she cares that she isn't enough for her "average savings in her 40s." How does the FP view the household situation? Mitsuaki Yokoyama of FP will answer. [Chart] What is the average annual income, savings, and living expenses of a single woman in her 40s living in Tokyo?

[Consultant's worries]

This is DINKS. I think the couple will continue to grow older, but I'm worried that the current way of saving money will continue to be okay. Due to the influence of the corona, the allowance payment decreased and the income decreased slightly. After that, I couldn't save much. However, if you look at the "average savings amount in your 40s" in articles on the Internet, you will find that it is 10.12 million yen in the second year of Reiwa. We don't have enough of it, and we have a mortgage. Do other households of the same age have average savings? We would like to tell you the average amount of money that we and our spouse should aim for, and we would like to increase our savings with that as our goal. Also, if you want to adjust the pace of your savings to the people in the world, how should you reduce your spending? Looking back on my life after my income decreased, I think that the change was that I started using some subscriptions because I thought that the use of delivery, the use of online supermarkets, and the fixed amount were more advantageous. Is this usage not good? I feel like I'm not the only one doing it properly, and I'm not confident. We would appreciate it if you could give us some advice so that you can manage it in the same way as a general household. [Consultant profile] ・ Female, 43 years old, office worker.Husband, office worker, 43 years old, take-home income monthly income: consultant 204,000 yen, husband 305,000 yen, annual bonus: consultant about 600,000 yen, no husband, savings: deposits and savings 8.5 million yen, housing loan: balance 3200 10,000 yen (borrowed 6 years ago, interest rate 0.975%, 35-year loan) ・ Estimated monthly expenditure: 492,000 yen [Breakdown of monthly expenditure] ・ Housing expenses (housing loan + management expenses): 150,000 yen ・Food expenses (including eating out): 72,000 yen ・ Utilities expenses (electricity / water): 18,000 yen ・ Communication expenses (2 smartphones / net line): 17,000 yen ・ Life insurance premiums: 91,000 yen ・Daily necessities: 6000 yen ・ Medical expenses: 7000 yen ・ Educational expenses (wife lessons): 7000 yen ・ Transportation expenses: 9000 yen ・ Clothing expenses: 2000 yen ・ Entertainment expenses: 25,000 yen ・ Entertainment expenses: 4000 yen ・ Kozukai ( For couples): 50,000 yen, others: 32,000 yen

Next page: [FP answer] Last updated: MONEY PLUS