"Just paying hometown tax" does not save tax!Introducing two ways to reduce taxes Hometown and tax payment mechanisms and usage <Part 2> --NTERNET Watch

The procedure method changes depending on the number of donations

Just paying your hometown tax will not return the tax.In order to receive a tax deduction, you must file a tax return in principle.

When the application for donation is completed to the local government, the donation receipt certificate will be sent by mail from the local government where you can prove that you have donated.

The sending time varies depending on the municipality, but it is often sent in about two months from the date of application.In the case of multiple municipalities, all will be filed and the tax return to the tax office in resident tax by March 15 of the following year.

The specific tax return method will be introduced below, but in the case of the final tax return, fill out the certificate of donation receipt and the tax return from the end of the year to January.And submit.

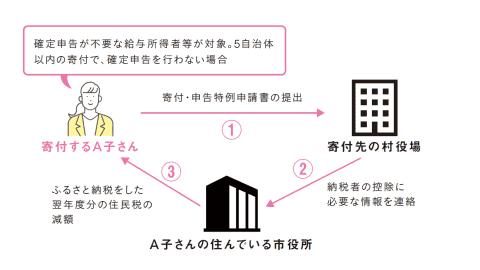

Another procedure method is to use a "one -stop special case" that will return tax without file a tax return if there are 5 or more donations.The specific procedures and precautions for receiving this special application are also introduced below.

[Glossary] withholding slip: The total salary paid by the company in that year, the bonus, etc., and the amount of the income tax deducted from it.It is distributed from the end of the year to January from the place of work.