If you throw away the hospital receipt, you will lose ... "LASIK treatment" is also eligible for those who can receive deduction even if "medical expenses 100,000 yen or less"

* This article is a re -edited part of Hideki Deguchi's "Tax books that you know as you know" (intellectual way of living).

写真=iStock.com/PeopleImages※写真はイメージです全ての画像を見る(4枚)「年末調整」では控除を受けることはできない

If you want to save tax, storage and aggregation of the receipt, which is the evidence you have spent, is indispensable.Depending on your efforts, you can save taxes: medical expenses deduction.

Medical expenses deductions are a system that can deduct a certain amount of medical expenses paid by the person in one year from the amount of income.There are two points to use this system.

One is to file a final tax return.The other is to keep the receipt.

The first point is that in the year -end adjustment that the company does, it is not possible to receive a deduction, and if you do not file it yourself, you will not be able to receive a deduction.

The second point is that you need to keep your medical expenses receipt yourself.

In the actual tax return, you need a “withholding slip” created by the company's year -end adjustment and a “medical expenses deduction statement” created based on the receipt of medical expenses.

In addition, if there is a “medical expenses notification” from medical insurers, the statement of medical expenses deduction should be omitted, and the total amount described in the notification should be entered.

In the past, what was submitted with a receipt for medical expenses has been replaced by the attachment of all medical expenses deductions since 2017.At the time of the declaration, it was mandatory to attach a statement aggregated at the payment destination of hospitals and pharmacies for each person who received medical care, and the receipt could not be attached.The taxpayer will keep the receipt of medical expenses for five years.

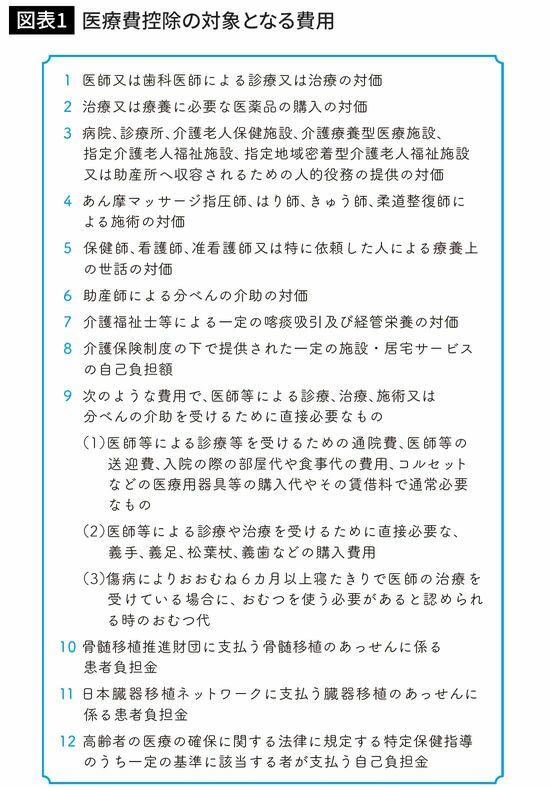

The medical expenses deduction is the amount paid to the medical treatment paid at the hospital, the medicine fee, etc., and the medical expenses that exceed 100,000 yen per year or 5 % of the income amount of the year are deducted.It will be eligible.

次ページ123関連記事「忘れると8万5000円の損」年末調整で多くの人が知らずに損をしている"ある控除"「取りやすいところから徹底的に取る」政府がたばこの次に増税を狙っている"ある嗜好品"「配偶者のパート年収はいくらにするべきか」税理士が教える"パートの4つの壁"【税金・年末調整BEST5】ランキング#税金・節税 #医療費控除 #書籍抜粋