Sales of small household appliances slowed down, Supor's net profit increased slightly, and Xinbao's net profit dropped by 30%

Despite the blessing of the concept of lazy economy and smart life, home appliance companies are still not easy to live.

According to the total data of AVC's omni-channel push, the retail sales of small kitchen appliances (12 categories) in 2021 will be 51.4 billion yuan, down 14.1% year-on-year, and the retail volume will be 237.44 million units, down 13.5% year-on-year.

In contrast, the realization of other home appliance categories is much better. Such as air conditioners and refrigerators in major appliances, integrated stoves and dishwashers in kitchen appliances, and the entire cleaning appliances, all achieved positive growth in sales.

This of course does not mean that the home appliance market is so hot. On the contrary, in the past year, the vast majority of home appliance categories have been trembling.

There are many factors that cause the industry's embarrassment, but the sharp rise in the prices of upstream copper, aluminum, stainless steel and other bulk raw materials is the culprit.

As a result, home appliance companies have entered the embarrassing situation of "stagflation": under the rise of both the cost of raw materials and the retail price of products, the total demand is at risk of shrinking.

01 Rising raw material prices drive down profits

The industry is so cold, and small electric companies feel the deepest.

On February 26, Xinbao Co., Ltd. announced its 2021 performance report. During the reporting period, Xinbao's revenue increased by 13.05% year-on-year, but the net profit attributable to the parent company fell sharply by 29.15%. Speaking of Xinbao, many users are not unfamiliar with it. After all, it once became a hit with the exclusive domestic agent "Mofei". It's just that Xinbao is no longer angry at the moment.

According to Xinbao's explanation, the main reasons for the decline in profits are: the rapid appreciation of the RMB against the US dollar in the early 2021 and the sharp rise in the prices of bulk raw materials, which will have a greater impact on the profitability of the company's products in the short term.

Of course, Xinbao shares are not the most disappointed in the small electricity market. Winning this "honor" belongs to Bear Electric. As a once prominent small electric dark horse, in the first three quarters of 2021, the company achieved revenue of 2.365 billion yuan, a year-on-year decrease of 5.32%, and the current net profit was 189 million yuan, a year-on-year decrease of 41.29%.

Compared with the sharp decline in the profits of Xinbao Co., Ltd. and Xiaoxiong Electric Appliances, Supor and Joyoung Co., Ltd. are much more stable. According to the latest data, Supor's net profit attributable to its parent company in 2021 will increase by 5.29% year-on-year. Even so, the sharp rise in the prices of bulk raw materials also lowered Supor's comprehensive gross profit margin by 0.38 percentage points.

Taking a closer look at the quarterly results, the development of the entire industry becomes clear at once.

According to the time series, in addition to the high growth in the first quarter (except for Xiaoxiong), the small electric brand showed a slowdown in the second and third quarters - negative growth trend, and then the fourth quarter was a recovery and return to varying degrees.

In the first stage, affected by the low base in the first quarter of 2020 and the fact that the cost of raw materials has not been fed back to the sales terminal, major brands achieved a good start in the first quarter; in the second stage, the price of raw materials was fully reflected in the cost field, and the performance in the second and third quarters declined. Obviously; in the third stage, due to the improvement of operational efficiency, the initial effect of the price increase strategy, and the restraint of the rise in the cost of raw materials, the performance of small power companies gradually recovered.

Focusing on the brand level, Supor's overall performance is the best throughout the year, but mainly due to the strong performance in the first quarter, it seems that the third and fourth quarters have not fully recovered. Joyoung is remarkable, with the smallest decline in the third quarter and the most stable in the first three quarters. Xinbao experienced a strong rebound in the fourth quarter after experiencing a sharp decline in the second and third quarters. Bears are expected to have the largest annual decline. Whether they can rebound quickly depends on the specific data in the fourth quarter.

02 Small appliances "dare not" to raise prices

Everything seems to be developing in a good direction, but there are too many uncertainties.

The reason is that the sword of Damocles is always hanging over the head: although the price of raw materials has risen slowly, it is still high. Another important factor is that the price increase effect of small kitchen appliances is not ideal.

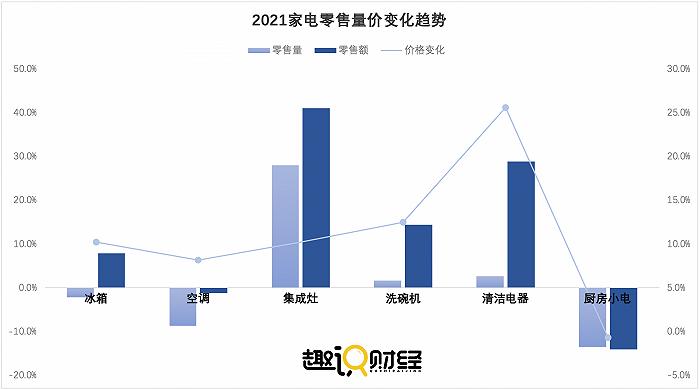

According to the total data pushed by AVC, in 2021, the retail volume of refrigerators in major appliances will decrease by 2.1% year-on-year, but the retail sales will increase by 7.9% year-on-year; the retail volume of air conditioners will decrease by 8.7%, and the retail sales will decrease slightly by 1.2%; the retail volume of the integrated stove market will increase year-on-year. 28%, and retail sales increased by 41% year-on-year; the dishwasher market retail volume increased by 1.7% year-on-year, and retail sales increased by 14.4% year-on-year; the retail sales of cleaning appliances increased by 2.6% year-on-year, and retail sales increased by 28.9% year-on-year. The retail sales of small kitchen appliances (12 categories) fell by 13.5% year-on-year, and retail sales fell by 14.1% year-on-year.

As shown in the figure above, with reference to the relative changes in retail volume/price, the overall price changes of major home appliance categories in 2021 can be roughly estimated. Among them, the price of clean electrical appliances has increased the most, up to 25.6%, while other household appliances are basically maintained at around 10%.

According to general business logic, the improvement of product performance can lead to an increase in value, and the price increase will come naturally. In addition, even if the performance of the product remains unchanged, rising costs such as raw materials can push up the retail price of the product.

Judging from the current market environment, rising raw material costs generally exist in major home appliance categories, while product upgrades occur more in new categories such as dishwashers and cleaning appliances. But in any case, the probability of falling product prices is very small.

Industry person Zhou Fei also holds a similar view. The home appliance market is on the road of consumption upgrading, and the trend of price reduction and promotion is not strong, and even the Double Eleven price war has not started. "Of course, the main reason is that the cost of raw materials is rising, and lowering prices means losing money."

According to a feedback from Wu Ang, a salesperson engaged in small kitchen appliances, large appliances require a large amount of components and are less affected by price, but small appliances are mostly supplementary consumer products, which are greatly affected by price fluctuations. "In economic terms, small electricity is more flexible; in our own words, we dare not cut prices."

This may, to a certain extent, reveal the reason for the decline in the price of small kitchen electricity: "If you don't want to, you can't."

But Wu Ang may have said a little less, that is, the technical threshold of small kitchen appliances is relatively low, and the market competition is extremely fierce, which also makes the price increase strategies of major brands more cautious.

03 New students in sight?

Apart from raw materials, rising overseas costs and tight international logistics are also important factors limiting corporate profits.

But no one wants to give up the fat in the overseas market. The disruption to overseas supply chains caused by the epidemic has also given domestic companies greater opportunities. As a result, many home appliance companies take into account both domestic and overseas, using the domestic market as the cornerstone and the international market as an important increment, "two fists beat people".

Such as Xinbao, whose overseas revenue accounts for nearly 78%, although the short-term fluctuations are relatively large, it has really opened up the market space.

In addition, increasing the research and development of new products and improving the efficiency of enterprise management have also become an important support for enterprises to cope with rising costs.

In 2022, Joyoung will start a new brand upgrade, use space technology to lead product innovation, and create a "space kitchen". For example, space hot water purification relying on space clean hot water technology, space air bombing relying on space 360° hot air circulation technology...

Mofei (Xinbao) has also recently launched a new smart washing machine for cleaning appliances, and the matrix of cleaning appliances has been continuously enriched and improved.

After experiencing high performance growth - profit decline - strong recovery, the first quarter of 2022 may usher in the final touchstone. This may also be the best opportunity for small power companies to prove themselves. Success will usher in a new life, and failure will continue to sink.